taxation

Type of resources

Available actions

Topics

INSPIRE themes

federalThemes

Keywords

Contact for the resource

Provided by

Years

Formats

Representation types

Update frequencies

status

Service types

Scale

-

Characteristics of the cadastral parcels - Condition of the building corresponds to the dataset describing the physical characteristics of the built-on parcels such as recorded by the FPS Finance for tax purposes. This dataset is composed of seven classes. The first class shows, at the national level, for each type of built-on land the total number of parcels as well as the number of parcels meeting various qualitative criteria (such as the number of parcels equipped with central heating, or the number of parcels built before 1900). The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities, cadastral divisions and statistical sectors. The dataset can be freely downloaded as a zipped CSV.

-

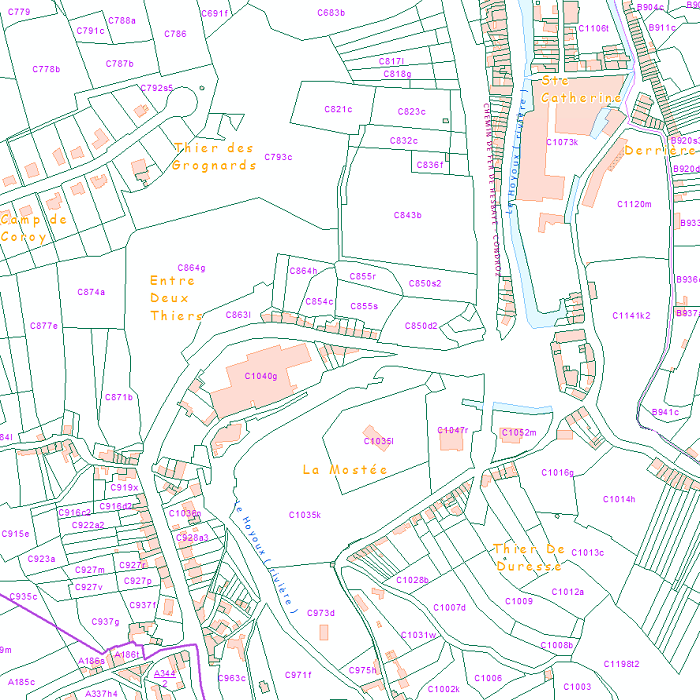

CadGIS Viewer is an application developed by the General Administration of Patrimonial Documentation of the FPS Finance. This application allows to: - consult the current situation of the land register plan and the administrative units and print them out; - consult all the tax situations since 2018 (situation as on 1 January) for the land register plan and administrative units; - search and geolocate the objects on the land register plan on the basis of space characteristics or queries; - ask for and print out cadastral plan parcels within a certain range around or adjacent to one or more parcels ; - search graphically on the map for surveyors' plans (only for surveyors); - add additional data to the map, both from a predefined list (IGN - Belgian national geographical institute’s aerial photographs, Cartoweb, regional reference frames such as GRB and PICC, ...) as well as other data via the URL of web services.

-

Characteristics of the cadastral parcels - Rights of real estate companies corresponds to the dataset describing the legal persons holding real rights on the parcels such as recorded by the FPS Finance for registration purposes. This dataset is composed of seven classes. The first class shows, at the national level, for each cadastral nature and for each type of real right, the number of parcels, their total cadastral income, as well as for each category of economic activity, the number of parcels on which real estate companies hold the concerned real rights (i.e. the companies of L class from NACE classification). The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities, cadastral divisions and statistical sectors. The dataset can be freely downloaded as a zipped CSV.

-

Distribution of real estate assets - real estate companies corresponds to the dataset relating to the distribution of real estate assets owned by legal entities such as recorded by the FPS Finance for tax purposes. This dataset is composed of eight classes. The first class mentions, at national level, for each cadastral income bracket, the number of legal entities with real estate activity (that is to say, registered under the code L of NACE nomenclature) and with real estate capital valued in the relevant bracket as well as the total and median cadastral income of the parcels held by these entities. The assessment of the cadastral income takes into account the shares actually held. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, districts, municipalities, land register divisions and statistical sectors. The last class includes this information at the level of the countries for the legal entities which are not settled in Belgium but wich are nevertheless reigstred at the Carrefour Banque of the Entreprises.The dataset can be freely downloaded as a zipped CSV.

-

Foreign real estate - Owners' profile corresponds to the dataset describing the profile of Belgian taxpayers (natural persons) holding real estate abroad. This dataset is composed of five classes. The first shows, at national level, by age and sex category, the number of individuals holding a real right that allows enjoyment over foreign property, the total number of foreign properties held by these individuals, and the number of properties by foreign country or territory. The number of properties takes into account the shares actually held. The second class presents this information at the level of the three regions. The following classes do the same for provinces, arrondissements and communes. The dataset is freely downloadable as zipped CSV files.

-

Owners' origin - Legal persons corresponds to the dataset describing the origin of the legal persons holders of real rights over immovable properties located in Belgium according to the municipality of their headquarters for legal persons settled in Belgium and according to the country or territory of their headquarters for foreign legal persons. This dataset is made up of seven classes. The first class shows, at national level, for each type of property, the total number of parcels, the number of parcels held by holders from each Belgian municipality and the number of parcels held by holders from each country or territory. The number of parcels takes into account the shares actually held. The second class shows this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities, land register divisions and statistical sectors. The dataset is freely downloadable, in the form of zipped CSV files.

-

Foreign real estate - Property characteristics corresponds to the dataset of foreign real estate held by belgian taxpayers as declared to the FPS Finance (only the holders of rights allowing the enjoyment of the property are taken into account). This dataset consists of one class. This class includes, for each foreign country or territory, the number of properties in each category, the total cadastral income of these properties, the median cadastral income of each category, as well as the 25 and 75 percentiles of the cadastral income of each category.

-

Distribution of real estate assets - Legal persons corresponds to the dataset relating to the distribution of real estate assets owned by legal entities such as recorded by the FPS Finance for tax purposes. This dataset is composed of eight classes. The first class mentions, at national level, for each cadastral income bracket, the number of legal persons grouped together by economic activity with real estate capital valued in the relevant bracket as well as the total and median cadastral income of the parcels held by these entities. The assessment of the cadastral income takes into account the shares actually held. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, districts, municipalities, land register divisions and statistical sectors. The last class includes this information at the level of the countries for the legal entities which are not settled in Belgium but wich are nevertheless reigstred at the Carrefour Banque of the Entreprises. The dataset can be freely downloaded as a zipped CSV.

-

Buyers' origin - Legal persons corresponds to the dataset describing the origin of the buyers (legal persons) of real estate located in Belgium according to the municipality of their headquarters for legal persons settled in Belgium and according to the country or territory of their headquarters for foreign legal persons (headquarter at the date of the deed). This dataset is made up of seven classes. The first class shows, at national level, for each type of property, the total number of parcels, the number of parcels acquired by buyers from each Belgian municipality and the number of parcels acquired by buyers from each country or territory. The number of parcels takes into account the shares actually acquired. The second class shows this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities, land register divisions and statistical sectors. The dataset is freely downloadable, in the form of zipped CSV files.

-

Real estate leases - annual version corresponds to the dataset describing leases on real estate items as recorded for registration purposes by the FPS Finance. This dataset is composed of five classes. The first class shows, at the national level, for each type of lease, the number of leases registered, the nature of the parties concerned by the contract and the median rent of the properties concerned. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities. The dataset can be freely downloaded as a zipped CSV.

geo.be Metadata Catalog

geo.be Metadata Catalog