CSV

Type of resources

Available actions

Topics

INSPIRE themes

federalThemes

Keywords

Contact for the resource

Provided by

Years

Formats

Representation types

Update frequencies

status

Service types

Scale

Resolution

-

Characteristics of the cadastral parcels - Exemption from withholding tax on immovable property corresponds to the dataset describing the parcels exempted from withholding tax on immovable property. The first class shows, at the national level, the number of parcels per exemption category, the total amount of cadastral income of these parcels, their surface area as well as the median cadastral income of each category. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities, cadastral divisions and statistical sectors. The dataset can be freely downloaded as a zipped CSV.

-

Foreign real estate - Property characteristics corresponds to the dataset of foreign real estate held by belgian taxpayers as declared to the FPS Finance (only the holders of rights allowing the enjoyment of the property are taken into account). This dataset consists of one class. This class includes, for each foreign country or territory, the number of properties in each category, the total cadastral income of these properties, the median cadastral income of each category, as well as the 25 and 75 percentiles of the cadastral income of each category.

-

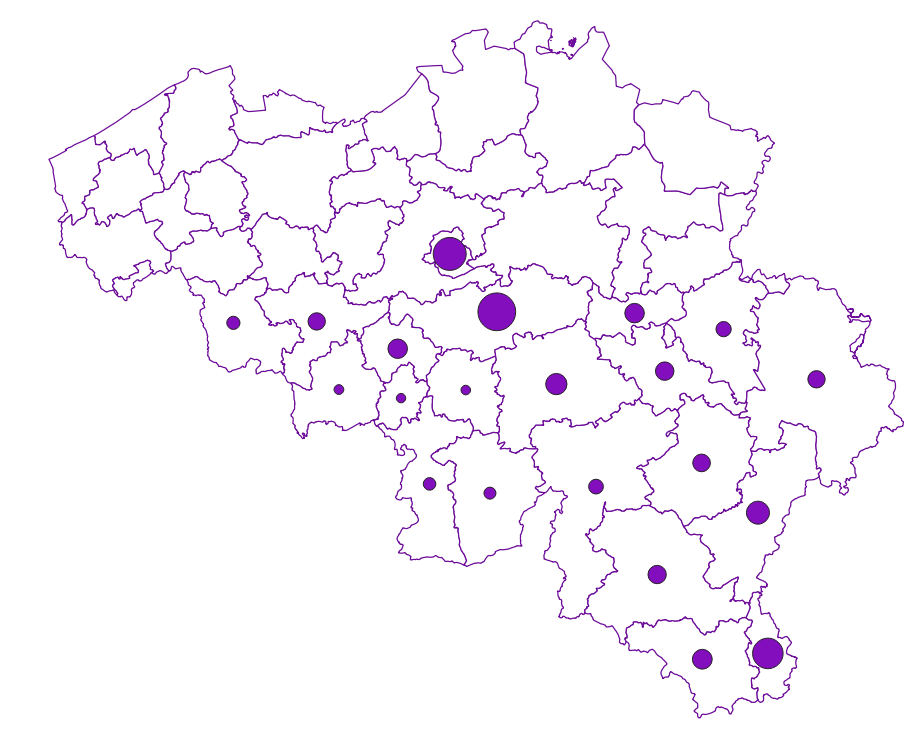

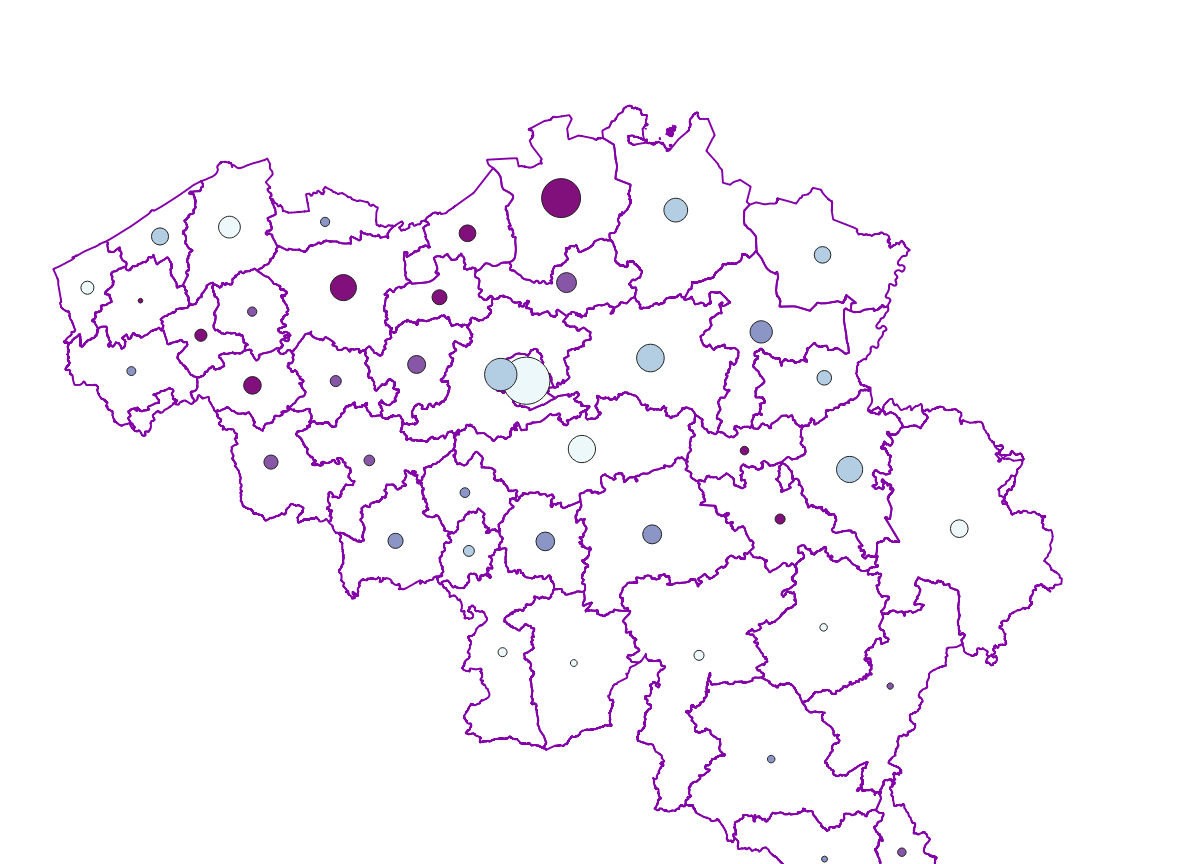

Buyers' origin - Natural persons corresponds to the dataset describing the origin of the buyers (natural persons) of real estate located in Belgium according to their municipality of residence for residents and according to their country or territory of residence for the non-residents (residence at the date of the deed). This dataset is made up of seven classes. The first class shows, at national level, for each type of property, the total number of parcels, the number of parcels acquired by buyers from each Belgian municipality and the number of parcels acquired by buyers from each country or territory. The number of parcels takes into account the shares actually acquired. The second class shows this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities, land register divisions and statistical sectors. The dataset is freely downloadable, in the form of zipped CSV files.

-

Inheritances corresponds to the dataset describing declarations of estate and the value of the assets included therein. This dataset is composed of five classes. The first class includes, at the national level, by age group, gender, and type of property, the number of deceased persons, the total value of the property, the median value of the property, the 25th and 75th percentiles of the value of the property, and the standard deviation of the value of the property. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, districts, and municipalities. The geographical distribution is based on the deceased's tax domicile. Since January 1, 2015, the FPS Finance is no longer responsible for the estates of deceased persons with a tax domicile in Flanders. Only data for tax domiciles located in the Walloon Region and the Brussels-Capital Region are included in the dataset. The dataset can be downloaded free of charge in zipped CSV format.

-

Foreign real estate - Owners' profile corresponds to the dataset describing the profile of Belgian taxpayers (natural persons) holding real estate abroad. This dataset is composed of five classes. The first shows, at national level, by age and sex category, the number of individuals holding a real right that allows enjoyment over foreign property, the total number of foreign properties held by these individuals, and the number of properties by foreign country or territory. The number of properties takes into account the shares actually held. The second class presents this information at the level of the three regions. The following classes do the same for provinces, arrondissements and communes. The dataset is freely downloadable as zipped CSV files.

-

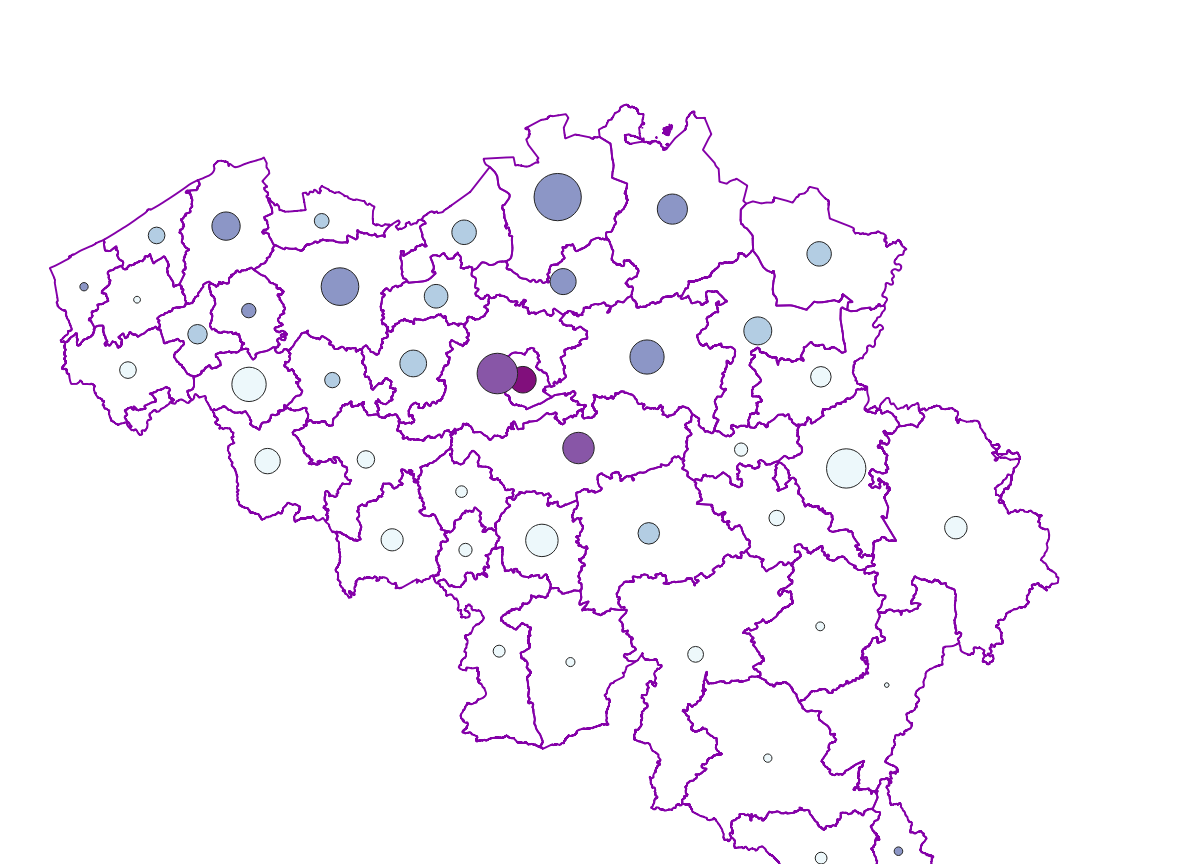

Notifications of the cadastral income corresponds to the dataset describing the new cadastral incomes of property located in Belgium that has been notified to the taxpayer. This dataset is made up of seven classes. The first class includes, at national level, by fiscal status, by nature of cadastral income and by category of motivations, the number of cadastral incomes notified, the total amount of cadastral incomes notified, the median cadastral income notified, the 25th and 75th percentiles of cadastral incomes notified and the standard deviation of cadastral incomes notified. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities, cadastral divisions and statistical sectors. The dataset can be freely downloaded as a zipped CSV.

-

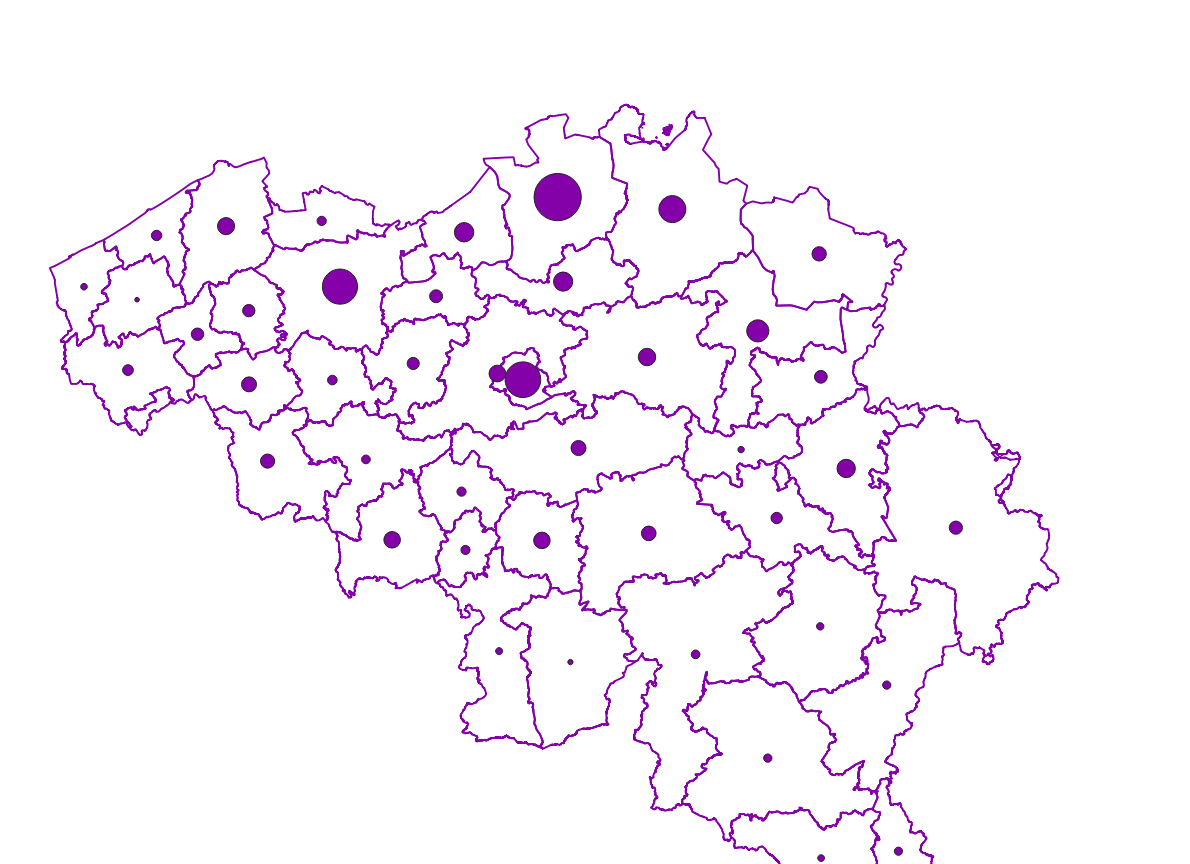

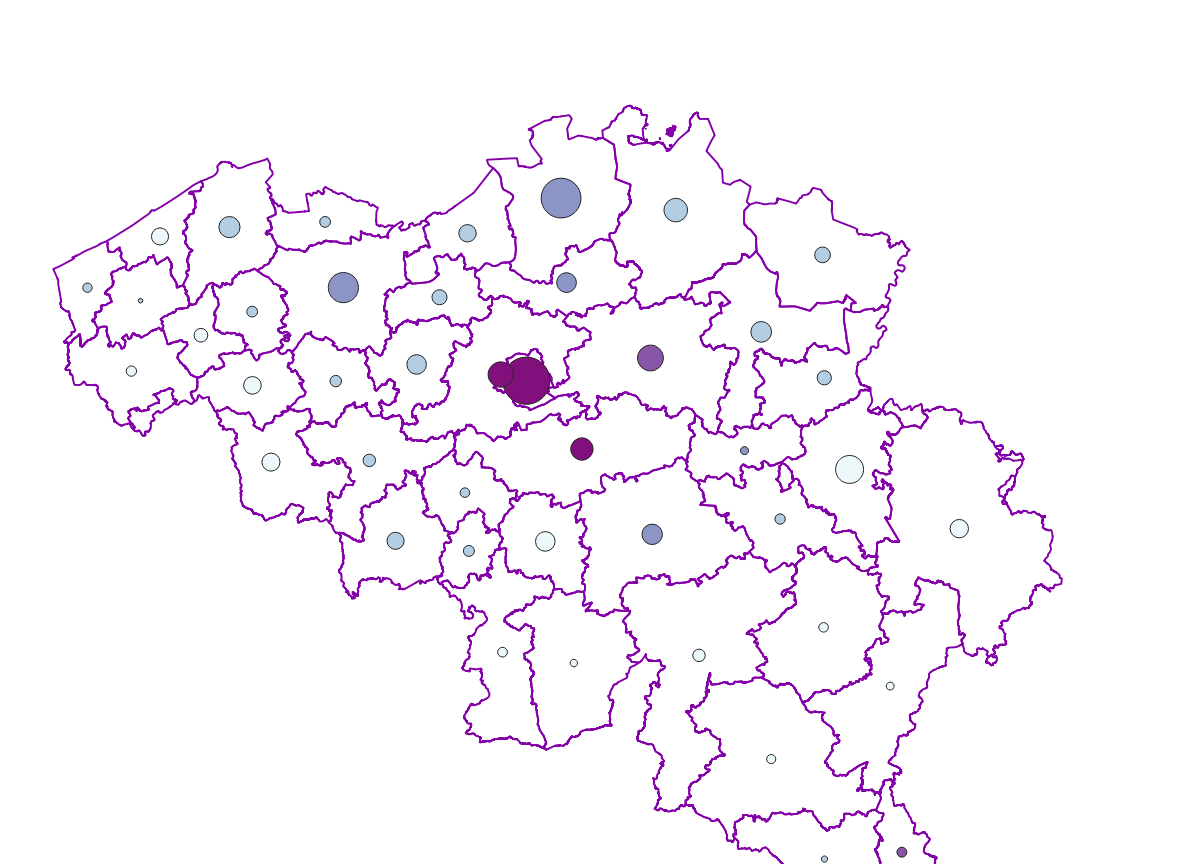

Real estate transactions corresponds to the dataset describing transactions of real rights on real estate property such as recorded by the FPS Finance for registration purposes.This dataset is composed of seven classes. The first class shows, at the national level, for each cadastral nature and for each type of transaction, the number of parcels concerned by a transaction as well as market values of these transactions. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities, cadastral divisions and statistical sectors. The dataset can be freely downloaded as a zipped CSV.

-

The localised unemployment rate calibrated on the labour force survey (LFS), by administrative unit (region, province, district and municipality) for Belgium.

-

Real estate leases - annual version corresponds to the dataset describing leases on real estate items as recorded for registration purposes by the FPS Finance. This dataset is composed of five classes. The first class shows, at the national level, for each type of lease, the number of leases registered, the nature of the parties concerned by the contract and the median rent of the properties concerned. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities. The dataset can be freely downloaded as a zipped CSV.

-

Distribution of real estate assets - Legal persons corresponds to the dataset relating to the distribution of real estate assets owned by legal entities such as recorded by the FPS Finance for tax purposes. This dataset is composed of eight classes. The first class mentions, at national level, for each cadastral income bracket, the number of legal persons grouped together by economic activity with real estate capital valued in the relevant bracket as well as the total and median cadastral income of the parcels held by these entities. The assessment of the cadastral income takes into account the shares actually held. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, districts, municipalities, land register divisions and statistical sectors. The last class includes this information at the level of the countries for the legal entities which are not settled in Belgium but wich are nevertheless reigstred at the Carrefour Banque of the Entreprises. The dataset can be freely downloaded as a zipped CSV.

geo.be Metadata Catalog

geo.be Metadata Catalog