planningCadastre

Type of resources

Available actions

Topics

INSPIRE themes

federalThemes

Keywords

Contact for the resource

Provided by

Years

Formats

Representation types

Update frequencies

status

Scale

-

Mapping plan parcel - statistical sector corresponds to the dataset associating a plan parcel such as defined in article 2 of the Royal Decree of July 30th 2018 with the statistical sector including it. This dataset is composed of a single class mentioning the identifier of the plan parcels as well as the identifier of the statistical sectors. The dataset can be freely downloaded as a zipped CSV.

-

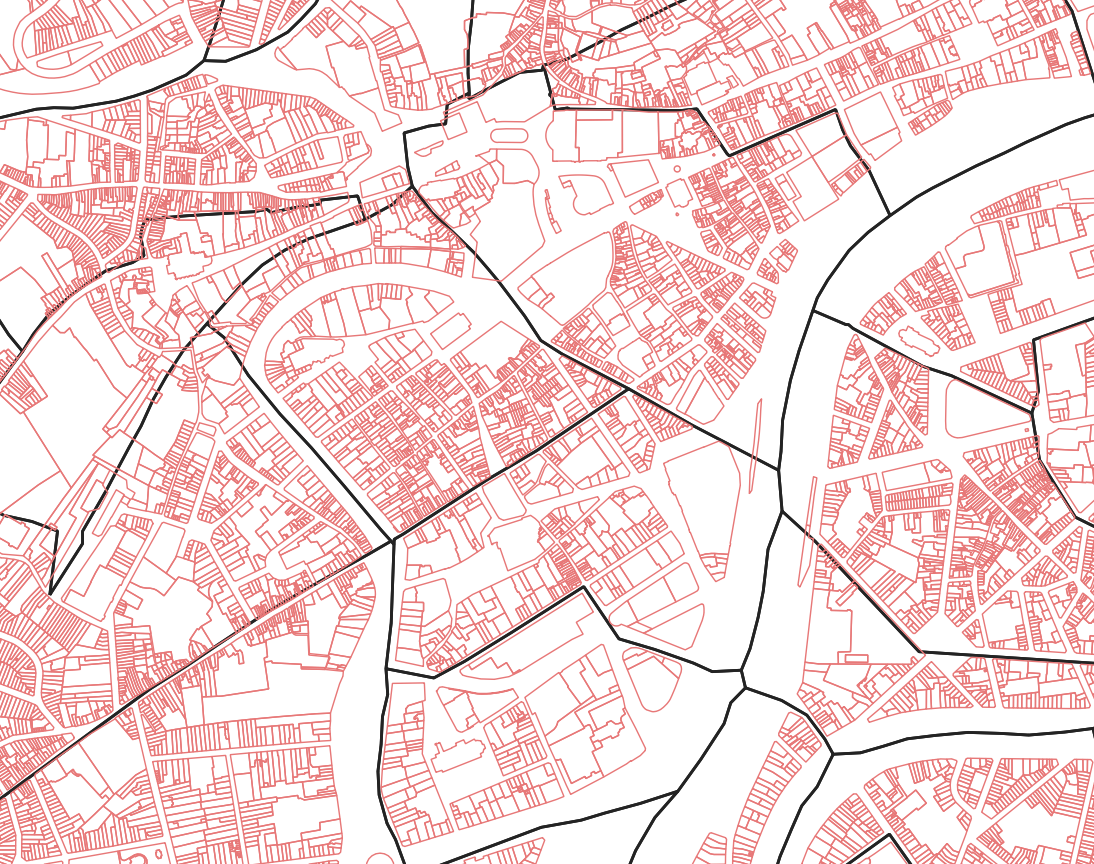

Cadastral parcels - monthly situation corresponds to the dataset of the monthly situation of the cadastral parcels layer from the Land Register plan. The dataset is composed of two classes. The first class contains the geometries of the cadastral parcels; the second is a class without geometry and corresponds to a code table of the different fiscal situations used in the first class. The dataset can be freely downloaded as a zipped shapefiles.

-

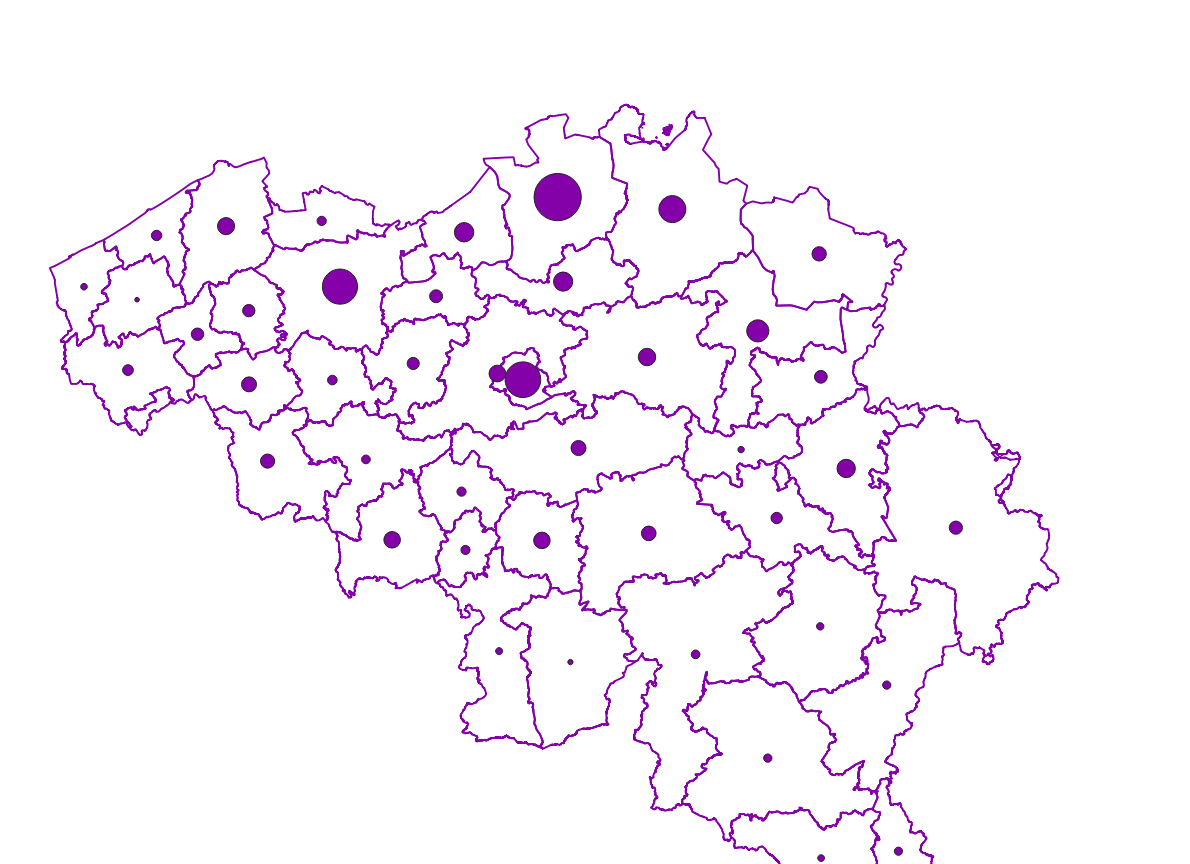

Characteristics of the cadastral parcels - Land use corresponds to the dataset describing the cadastral nature of the parcels such as recorded by the FPS Finance for tax purposes. This dataset is composed of seven classes. The first class shows, at the national level, for each type, the number of parcels, their cadastral income and their total surface area, as well as the median cadastral income of the plots. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities, cadastral divisions and statistical sectors. The dataset can be freely downloaded as a zipped CSV.

-

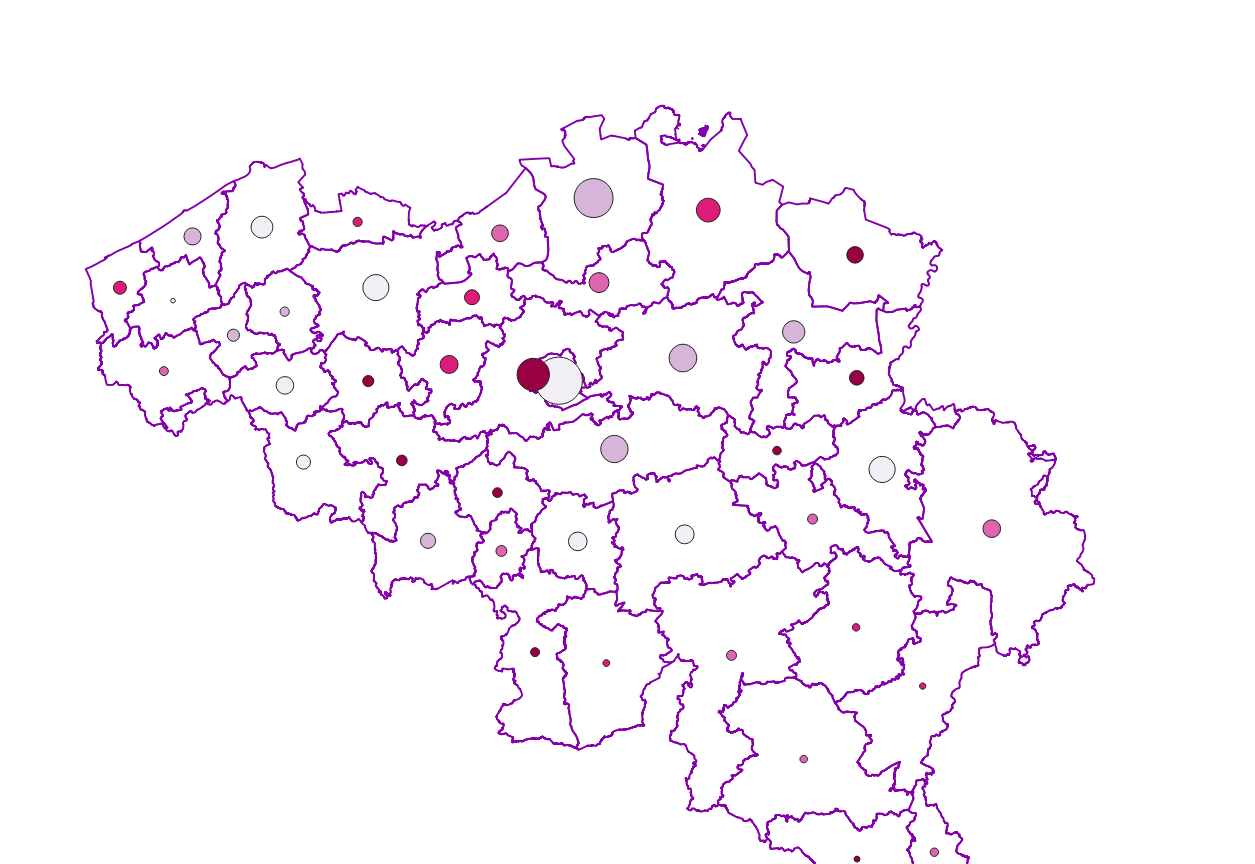

Foreign real estate - Owners' profile corresponds to the dataset describing the profile of Belgian taxpayers (natural persons) holding real estate abroad. This dataset is composed of five classes. The first shows, at national level, by age and sex category, the number of individuals holding a real right that allows enjoyment over foreign property, the total number of foreign properties held by these individuals, and the number of properties by foreign country or territory. The number of properties takes into account the shares actually held. The second class presents this information at the level of the three regions. The following classes do the same for provinces, arrondissements and communes. The dataset is freely downloadable as zipped CSV files.

-

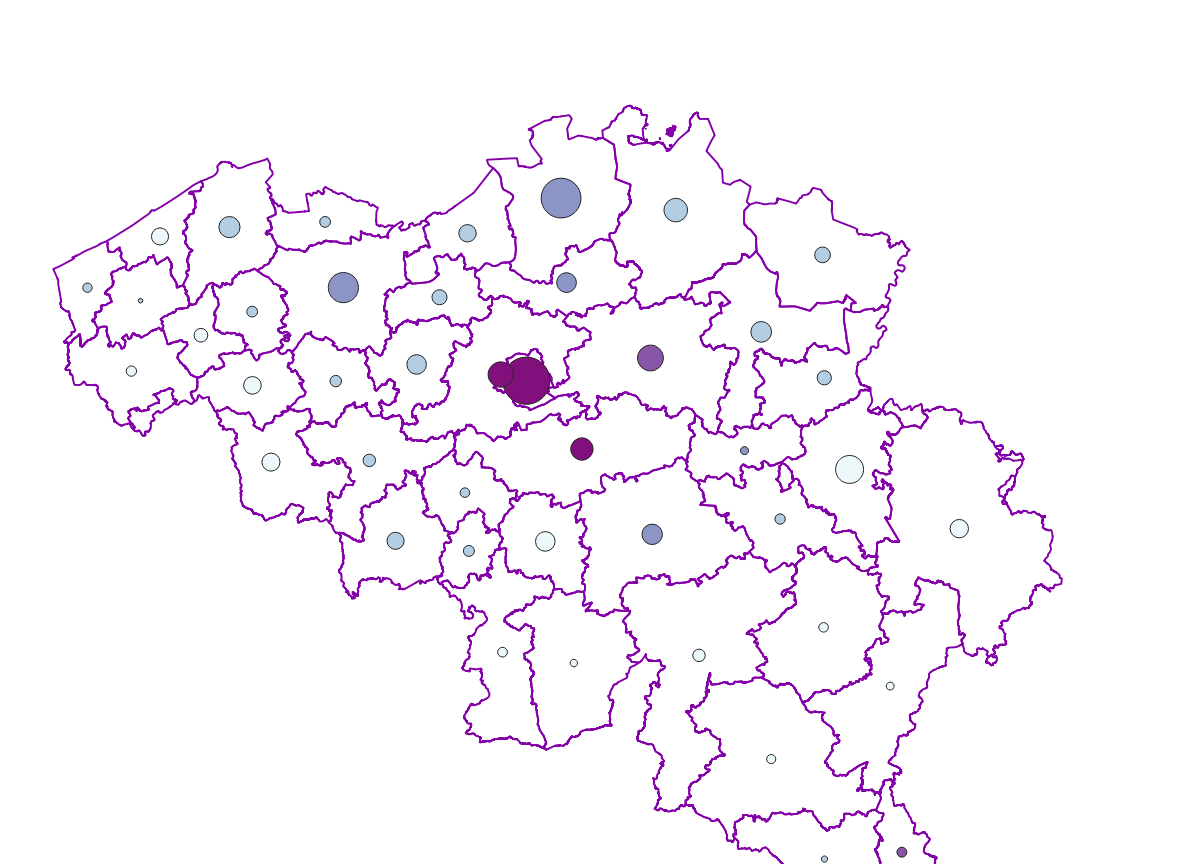

Real estate property dynamics corresponds to the dataset describing changes in ownership in Belgium as recorded by the FPS Finance. This dataset comprises seven classes. The first class includes, at national level, for each cadastral nature, the total number of parcels, the number of parcels that have changed ownership at different time intervals, the median and mean duration since the last change of ownership, the 25 and 75 percentiles of the duration since the last change of ownership, and the mean duration of ownership rotation over the entire existence of the parcels. The second class uses this information for all three regions. The following classes do the same for provinces, arrondissements, communes, cadastral divisions and statistical sectors. The dataset is freely downloadable as zipped CSV files.

-

Real estate leases - annual version corresponds to the dataset describing leases on real estate items as recorded for registration purposes by the FPS Finance. This dataset is composed of five classes. The first class shows, at the national level, for each type of lease, the number of leases registered, the nature of the parties concerned by the contract and the median rent of the properties concerned. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities. The dataset can be freely downloaded as a zipped CSV.

-

Foreign real estate - Property characteristics corresponds to the dataset of foreign real estate held by belgian taxpayers as declared to the FPS Finance (only the holders of rights allowing the enjoyment of the property are taken into account). This dataset consists of one class. This class includes, for each foreign country or territory, the number of properties in each category, the total cadastral income of these properties, the median cadastral income of each category, as well as the 25 and 75 percentiles of the cadastral income of each category.

-

Cadastral Parcels - INSPIRE corresponds to the dataset of Belgian plan cadastral parcels complying with INSPIRE specifications. This dataset is composed of two classes. The first class contains cadastral zoning and the second class contains cadastral parcel. The entire dataset can be downloaded via the ad hoc WFS.

-

Characteristics of the cadastral parcels - Exemption from withholding tax on immovable property corresponds to the dataset describing the parcels exempted from withholding tax on immovable property. The first class shows, at the national level, the number of parcels per exemption category, the total amount of cadastral income of these parcels, their surface area as well as the median cadastral income of each category. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities, cadastral divisions and statistical sectors. The dataset can be freely downloaded as a zipped CSV.

-

Real estate transactions - annual version corresponds to the dataset describing transactions of real rights on real estate property such as recorded by the FPS Finance for registration purposes. This dataset is composed of five classes. The first class shows, at the national level, for each cadastral nature and for each type of transaction, the number of real estate property concerned by a transaction as well as market values of these transactions. The second class includes this information at the level of the three regions. The following classes do the same at the level of provinces, arrondissements, municipalities. The dataset can be freely downloaded as a zipped CSV.

geo.be Metadata Catalog

geo.be Metadata Catalog